Fraud Prevention in the Age of AI: A Strategic Framework for Financial Institutions

In an era where fraud threats are escalating and customer expectations are higher than ever, financial institutions must find new ways to strike the balance between security and experience. Fraud prevention is no longer just about defense—it's about transformation. By integrating human expertise, process design, and advanced AI-driven technologies, financial institutions can create a proactive fraud detection ecosystem that minimizes false positives and protects customer trust.

The Cost of Inaction

The numbers speak volumes:

- Over 50% of financial institutions report increased fraud attempts year over year.

- 1 in 10 institutions faces more than 10,000 fraud attempts annually.

- Consumers report $10B+ in losses due to fraud.

- False positives comprise over 95% of AML alerts, costing institutions billions in compliance and lost customer goodwill.

Clearly, traditional approaches to fraud prevention are no longer sufficient. The challenge lies not only in detecting fraud but in doing so with surgical precision.

The False Positive Dilemma

Overly aggressive fraud detection models may flag legitimate transactions, leading to customer dissatisfaction, operational inefficiencies, and reputational damage. Studies show that:

- 1 in 5 flagged transactions is legitimate.

- 1 in 6 customers has experienced a valid transaction being declined.

Minimizing false positives is not just a technical priority; it's a business imperative.

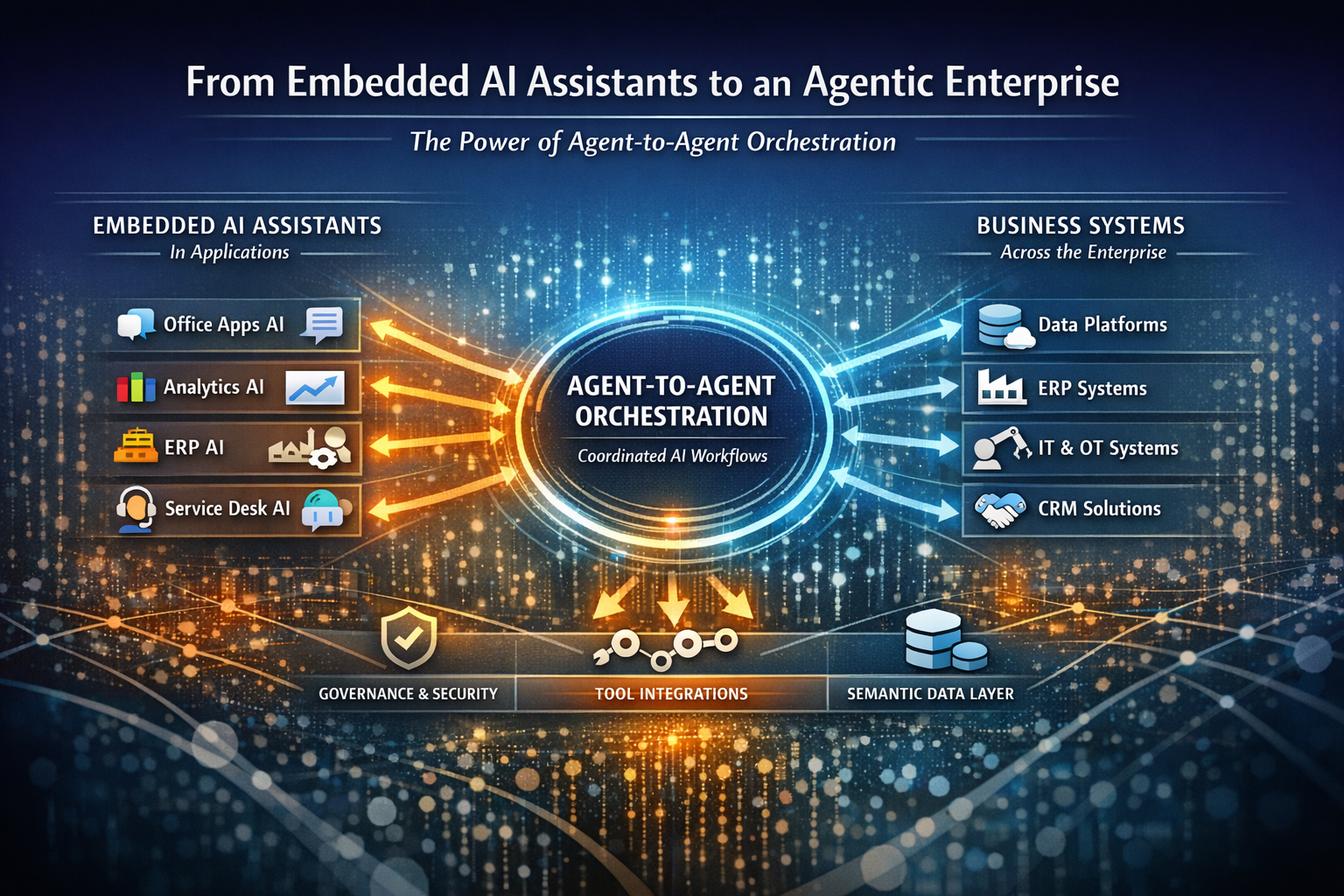

A Modern Approach: People + Process + Technology

To address today’s fraud landscape, organizations must adopt a triage framework that aligns:

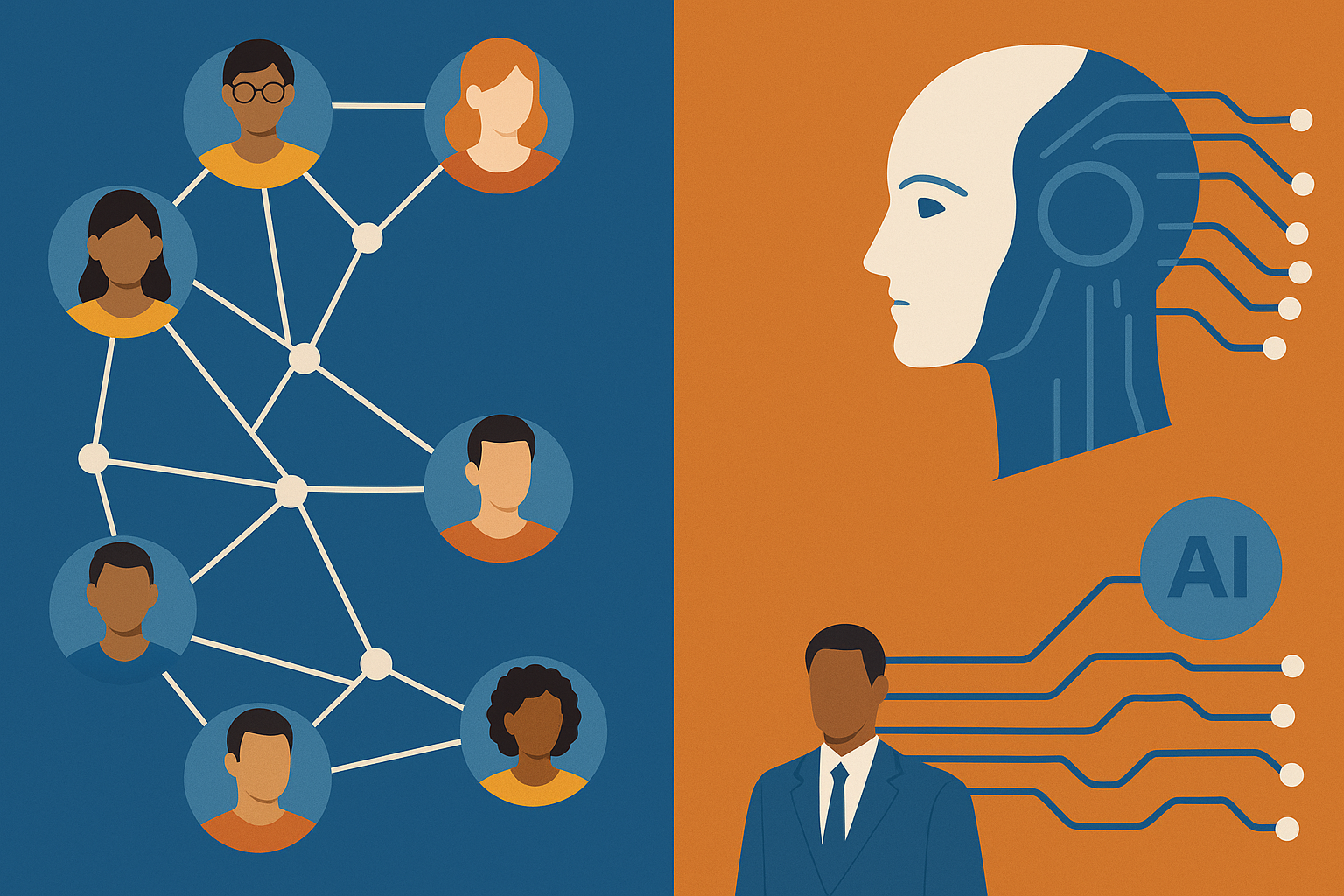

1. People: Human intelligence remains vital in interpreting edge cases, reviewing complex scenarios, and adjusting models based on real-world context. Ongoing training and a strong compliance culture are essential.

2. Process: Effective fraud prevention is built on strong governance, standardized playbooks, and multi-layered detection protocols. Continuous auditing and feedback loops ensure adaptability.

3. Technology: AI and ML algorithms can analyze millions of transactions in real-time, identify subtle anomalies, and reduce reliance on manual review. Emerging tools like NLP and Agentic AI expand this capability further by understanding unstructured patterns and adversarial behavior.

The Triage Framework in Action

A modern fraud prevention system incorporates three layers:

1. Machine Intelligence

ML models serve as the first line of defense, screening out normal transactions and escalating suspicious ones. Real-time anomaly detection significantly reduces the load on human investigators.

2. Human Judgment

Complex or ambiguous alerts are escalated to skilled analysts. Their contextual decisions ensure that no legitimate customer is wrongly denied service. Organizations should strengthen human-AI collaboration to optimize case triaging.

3. Feedback Loop

Insights from human analysis are fed back into AI models, improving precision and reducing future false positives. This iterative learning cycle is essential for model evolution and trust.

The Payoff: Smarter Security, Better Experience

An integrated fraud prevention strategy improves fraud detection rates while reducing customer friction. By combining real-time machine intelligence with human insight and adaptive processes, financial institutions can stay ahead of increasingly sophisticated threats.

The result? Lower fraud losses, fewer false positives, improved compliance efficiency, and a customer experience that inspires confidence.

Conclusion

Fraud is evolving—so must our defenses. Organizations that adopt a layered, intelligent fraud prevention framework will not only protect themselves from financial loss but will also differentiate through superior customer experience. The future of fraud prevention lies not in choosing between people or machines, but in leveraging the best of both in a continuously learning system.

About Author:

Towhidul Hoque is an executive leader in AI, data platforms, and digital transformation with 20 years of experience helping organizations build scalable, production-grade intelligent systems.